How to Turn Trust into Influence Across Finance, Events & Impact

What do intrapreneurship, sustainable investing, event innovation, and real estate strategy all have in common? They’re powerful frameworks for purpose-driven leadership—and this week’s Top Voices are living proof.

In this edition, discover six standout stories from changemakers transforming industries—from redefining climate finance and scaling innovation inside corporate giants to building personal brands with equity and designing experiences that spark emotional connection.

Whether you're a creator, investor, or rising leader, these voices offer clear direction at the intersection of climate, capital, creativity, and community.

✨ Learn how to turn trust into traction, design into emotion, and dollars into sustainable value—without burnout, compromise, or mission drift.

3 Corporate Innovation Moves That Create Startup-Level Impact—Without Quitting Your Job

On the October 7, 2025 edition of Top Voices Tuesday, host Michael Lopez welcomed Feras Asakrieh —VP of Innovation and a recognized leader in corporate transformation—to unpack the mindset, moves, and methods behind intrapreneurial success. Together, they explored how professionals can generate billion-dollar impact from within, without ever leaving their desk jobs.

What Happens When Intrapreneurs Go All In?

You don’t have to leave your company to create massive change. That was the driving message in this episode featuring Feras Asakrieh—whose journey from engineer to internal entrepreneur shows how corporate leaders can break barriers, launch ventures, and unlock true impact within the organizations they serve.

If you think you need to launch a startup to change the world, think again. This episode is a guidebook for intrapreneurs navigating red tape, building trust, and influencing at scale.

3 Game‑Changing Lessons for Corporate Builders

1. How to Lead Innovation Even Without the CEO Title

“You don’t have to be a CEO to make CEO‑level decisions.” — Feras Asakrieh

Feras showed that influence isn’t about your title—it’s about solving high-impact problems that others avoid. He launched internal ventures from within core business units, proving that intrapreneurship can thrive in structured environments.

To learn more about intrapreneurship in corporate settings, see “Why You Should Become an 'Intrapreneur'” (HBR) — a great resource on fostering innovation inside existing organizations.

2. Why Building Trust Is Your First Innovation

“If people don’t trust you, your ideas won’t go anywhere.”

Before pitching your big idea or seeking resources, Feras invested in creating credibility. Small wins, transparent communication, and consistency mapped into growing influence across stakeholder groups.

On leadership and trust: HBR reports that high-trust companies experience 50% more productivity and significantly reduced stress.

3. From Invisible to Influencer: Connect Across Silos

“Sometimes the real power is in being the connector between silos.”

The core of Feras’s strategy? Make others win. He tied diverse groups together, invited dissenting voices early, and gave collaborators visible recognition—turning cross‑team alignment into momentum.

Want to see how alignment across functions is done well? MIT Sloan discusses cross-functional connectivity in high-performing organizations.

Intrapreneurship: Leading Innovation Efforts in Established Organizations

What This Means for You

Feras Asakrieh’s journey highlights a powerful truth: you don’t need a new company to lead innovation—you just need a new approach.

By rethinking influence, prioritizing trust, and aligning teams around shared outcomes, Feras proves that intrapreneurs are the new architects of change inside large organizations.

“Innovation isn’t about technology. It’s about people, problems, and trust.” — Feras Asakrieh

For rising leaders in corporate roles, these insights offer not just inspiration—but a tactical roadmap for driving innovation from the inside out.

Next Steps to Grow with Purpose

📺 Watch the Full Episode of “Secrets of the Corporate Entrepreneur with Feras Asakrieh”

Connect with speakers:

- Follow Feras Asakrieh for sharp insights on enterprise transformation, leadership, and intrapreneurship.

Join the next episode of Top Voice Tuesday with Andy Wang on October 14 at 12:00 PM EST on LinkedIn Live. Register here!

📬 Get the most of the insights from our featured Top Voices in this episode!

- Learn from Michael’s latest thinking on change and transformation, along with current topics discussed on the Top Voice Tuesday Podcast and subscribe.

Weekly Newsletter Sign Up

Forging New Pathways for Climate Finance

How LinkedIn Is Fueling the Next Wave of Sustainable Investment Conversations

Finance meets purpose. Capital meets conscience.

In this Blue TV Replay, LinkedIn Top Voice and Sellovatorz, Inc. founder Denise Murtha Bachmann sat down with Darius Nassiry, Senior Fellow at the Columbia Center on Sustainable Investment, to explore how climate finance is evolving from policy to personal action.

Together, they unpacked how mobilizing capital for sustainability is no longer just a global policy issue—it’s a human one. From cities adapting to extreme weather to investors rethinking returns, this episode highlighted the intersection of finance, empathy, and innovation.

“We can invent new institutions and structures that make a more livable future. The economy isn’t fixed—it’s what we choose to build.” — Darius Nassiry

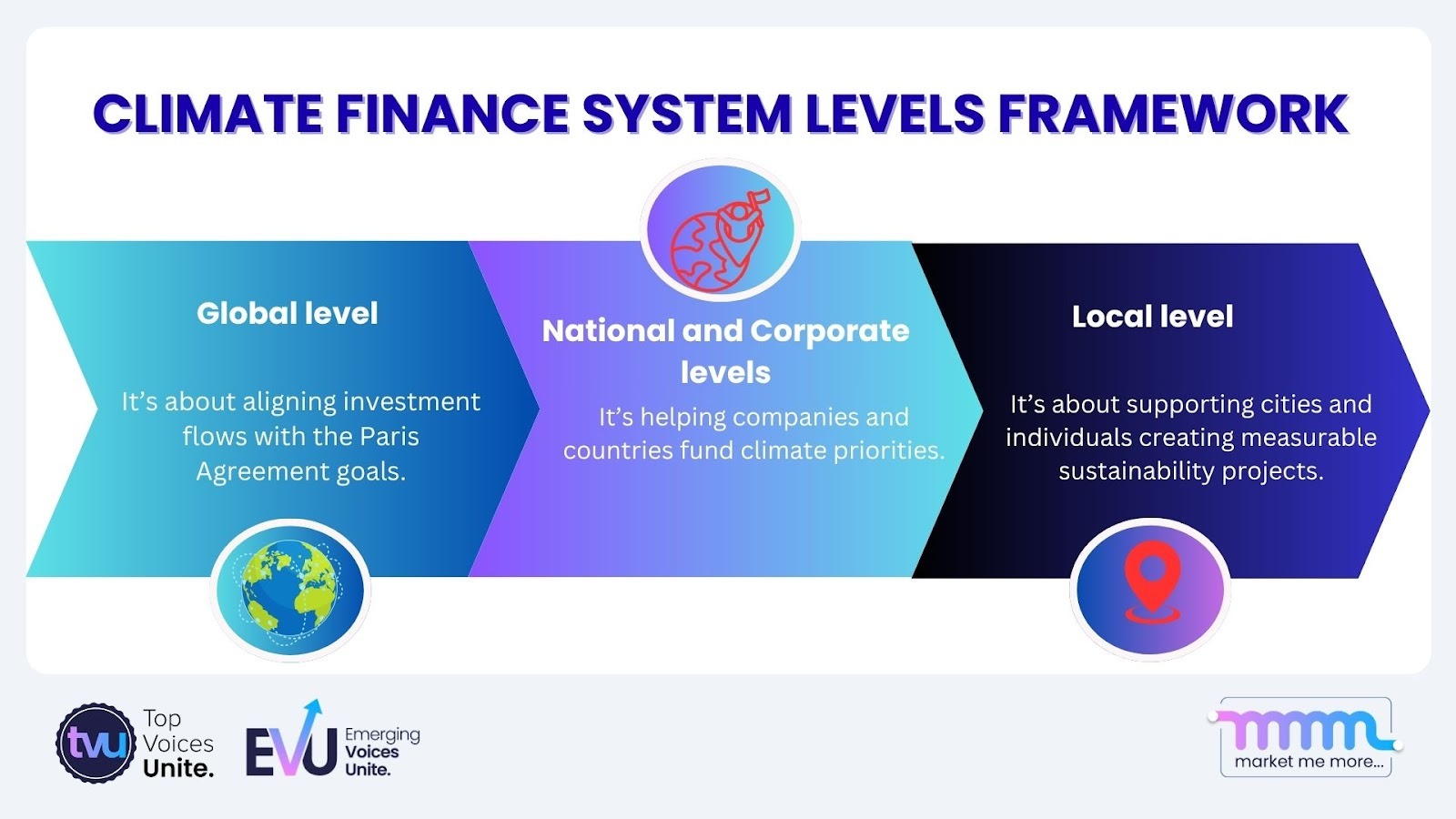

Climate Finance Redefined System Levels

Climate finance refers to how global, national, and local systems mobilize, manage, and allocate financial resources to fight climate change and build long-term environmental resilience. Darius broke it down simply:

- At the global level, it’s about aligning investment flows and financial commitments with the Paris Agreement goals to limit global warming and promote international cooperation.

- At the national and corporate levels, it’s about helping governments, institutions, and businesses fund climate priorities through innovation, regulation, and strategic partnerships that scale impact.

- At the local level, it’s about supporting cities, communities, and individuals in creating measurable, high-impact sustainability projects that reduce emissions and strengthen everyday resilience.

The City as the Climate Frontier

From New York’s emission-reduction laws to Los Angeles’s wildfire resilience efforts, urban areas are now the main stage for climate action.

Darius shared examples of Nordic collective municipal financing models, where cities pool resources to fund infrastructure, suggesting that a Cities Development Bank could help scale these ideas globally.

“Cities are where the infrastructure for our sustainable future will be built. We need to make sure they get the capital they need.” — Darius Nassiry

💡 Stat to Know

In 2023, multilateral development banks delivered a record USD 125 billion in public climate finance, with about 60 % ($74.7 billion) directed to low- and middle-income countries.(World Research Institute)

What You Can Do Now

- Start local: Explore how your city funds sustainability projects—transport, energy, or water management.

- Educate yourself: Follow thought leaders like Darius Nassiry to understand how finance and policy intersect.

- Engage on LinkedIn: Comment on sustainability posts, share research, or amplify success stories.

- Find your niche: Whether it’s carbon markets, renewables, or behavior change—pick a focus and go deep.

- Build community: Introduce two people in your network who could collaborate on a sustainability initiative.

Replay + Resources

📺 Replay the Full Episode: Blue TV: Forging New Pathways for Climate Finance 🔷 Learn more from Denise Murtha Bachmann – Sellovatorz.com 🔷Read the Research – Bridging the Gap and Follow Darius Nassiry

🔷 Book a 1:1 Sales Strategy Call with Denise → Scheduling Link

Next episode of Blue TV will be on September 24 at 11:00 AM ET | 10:00 AM CT on LinkedIn Live. Register here!

How to Build Wealth Through Real Estate: 5 Proven Insights from Top Investors

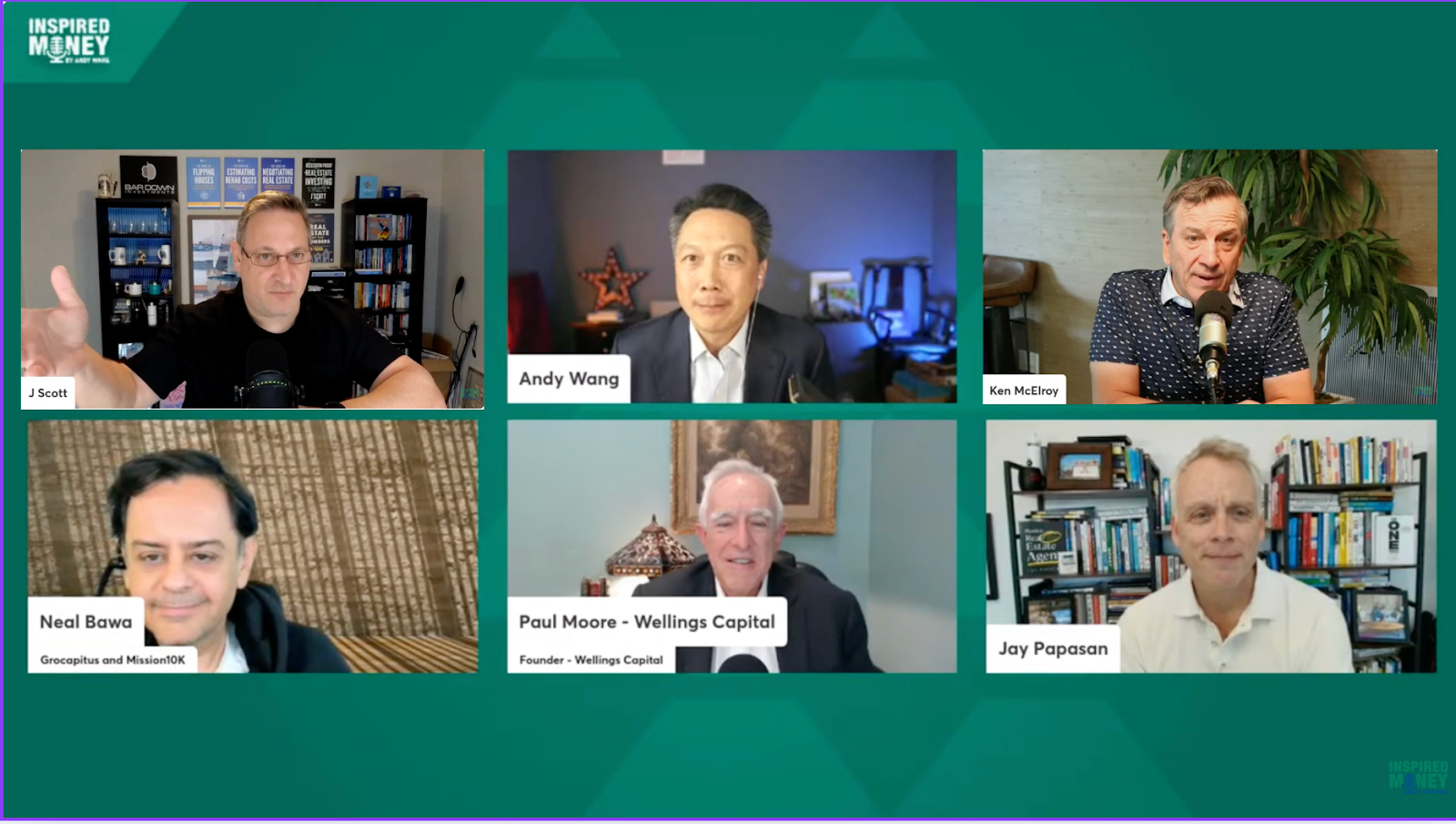

The October 8, 2025 episode of Inspired Money gathered five of the most respected voices in real estate investment to share real-world strategies that go beyond theory. Hosted by Andy Wang, the conversation featured Ken McElroy, Neal Bawa, Jay Papasan, J Scott, and Paul Moore, each bringing a unique perspective on everything from market timing to team building. Rather than chasing trends, this dialogue focused on building sustainable, long-term wealth through informed decisions and disciplined investing.

Before you buy your next property or invest in a syndicate, pause here.

This all-star panel of real estate strategists broke down the actual path to property wealth—beyond hype and headlines. Whether you're a first-time investor or scaling your portfolio, this episode is a masterclass in mindset, metrics, and modern investing models.

Here are the five real estate truths the pros want you to know:

5 Investor Insights That Could Transform Your Real Estate Strategy

1. Cash Flow Is King—With Margin for Errors

“You make your money when you buy, not when you sell.” — J Scott

J Scott emphasized the critical importance of rigorous underwriting. Overestimating rents or underestimating expenses—turnover, repairs, interest rates—can kill cash flow even in favorable markets.

This is reinforced by industry commentary. For instance, MRI’s blog on multifamily investing highlights how key metrics like NOI, cap rate, and cash projections must include conservative buffers to survive market shifts. How to analyze multifamily deals

2. Follow the People—Not Just the Places

“I invest where people are moving to, not where they’re moving from.” — Paul Moore

Paul Moore’s view: future rent demand comes from migration patterns, job growth, and affordability—not just vintage neighborhoods. Choosing markets with increasing population inflows helps sustain occupancy and rent growth.

Demographic shifts matter across real estate cycles, as analysis of market data sources shows. 7 Sources for Multifamily Market Data

3. Data Is Your Ally—But Only with the Right Questions

“Most investors don’t realize how many hidden risks are in their models.” — Neal Bawa

Neal Bawa highlighted how models can miss hidden pressures—deferred maintenance, vacancy spikes, cost creep. His approach uses tech and analytics to stress-test assumptions.

RealPage, a market analytics platform, demonstrates how data-driven platforms can provide visibility into rent trends, occupancy, and market projections—helping catch blind spots before they bite.

4. Start With People, Not Leverage

“Your first partner should be your property manager.” — Ken McElroy

Ken McElroy believes that trusted people—from property managers to legal and tax teams—are the foundation of scalable investing. Oversized debt with weak teams is a recipe for collapse under stress.

While specific online sources may vary, this concept is widely echoed in real estate education and blogs—emphasizing that systems break without reliable execution.

5. Due Diligence Shields Your Gains

“Real wealth is protected by due diligence.” — Jay Papasan

Jay Papasan underscored the value of mundane but essential tasks: title checks, zoning confirmation, tax history, and structural inspections. These guardrails often determine whether a property becomes an asset—or a liability.

Supporting this, Investopedia outlines how valuation methods, market comps, and risk analysis should be foundational for any real estate decision.

What Elite Investors Know That Most Don’t

Smart real estate investing isn’t about chasing trends—it’s about long-term fundamentals.

From Neal Bawa’s data-backed due diligence to Jay Papasan’s emphasis on operational discipline, this conversation pulls back the curtain on what separates seasoned investors from speculative buyers. Ken McElroy underscores that downturns often create the best buying opportunities mirroring Harvard’s findings on multifamily resilience. J Scott reminds us that managing wealth isn’t just about accumulation, but timing echoed in Fidelity’s income planning insights. And Paul Moore challenges us to build portfolios that not only grow but endure—balancing profit with purpose. These leaders aren’t just thinking about deals; they’re thinking about legacy.

As market conditions tighten and investor expectations rise, these lessons become non-negotiable. Whether you’re a first-time buyer or building a real estate portfolio, the golden thread is clear: your strategy is only as strong as your information, relationships, and discipline.

What’s Next?

🎧 Catch the full episode on-demand and share it with someone who needs to hear it.

- In YouTube: Investing in Real Estate: Building Wealth through Property Investments

Investing in Real Estate: Building Wealth through Property Investments

🎙️ Listen to past episodes of Inspired Money Podcast in different platforms here: Inspired Money with Andy Wang

🔎 Explore more from our Inspired Money host and guest speakers in this episode!

- Andy Wang to explore more insights and opportunity for the podcast

Company Website: Runnymede Capital Management

- Ken McElroy - Unlock the path to passive income with Ken’s real estate strategies, mindset tools, and community-focused investing.

- Neal Bawa - Explore how data, tech, and transparency are revolutionizing real estate with “The Mad Scientist of Multifamily.

- Jay Papasan - Master focus, productivity, and purpose-driven success with Jay’s timeless insights from The ONE Thing.

- J Scott - Learn the business behind multifamily investing from a Silicon Valley exec turned real estate mentor.

Company Website: Bardown Investments & Apartment Addicts

- Paul Moore - Level up your portfolio with Paul’s proven strategies across multifamily, self-storage, and commercial real estate funds.

How Design Becomes Healing: Behind the Ageless Evolution Summit

On the October 9, 2025 edition of Voices of the Week, host Nikki Estes sat down with creative lead Ash K, the design mind behind the revamped Ageless Evolution Longevity Summit. This deep dive into the event’s visual identity reveals the strategy, emotion, and collaboration that went into reimagining the brand—from bold “blobs” and vibrant gradients to next-gen speaker slides.

Designing with Purpose Before Pretty

Before you get wowed by the visuals, Ash K made it clear: design isn’t just about aesthetics—it’s about emotion.

“Event design is not about creating visuals that look good—it’s about making people feel something special the moment they walk into the event,” he said.

The newly unveiled brand identity reflects:

- Evolution as a theme, illustrated with shape-shifting blobs.

- Human-centered colors, transitioning from green to vibrant gradients that signify joy, energy, and transformation.

- A modern logo, merging letters to visually connect “Ageless” with “Evolution.”

- Futuristic design techniques, like glassmorphism, to elevate digital and physical materials.

Everything—from the website to the speaker stage—was curated to ensure attendees don’t just attend the event… they experience it.

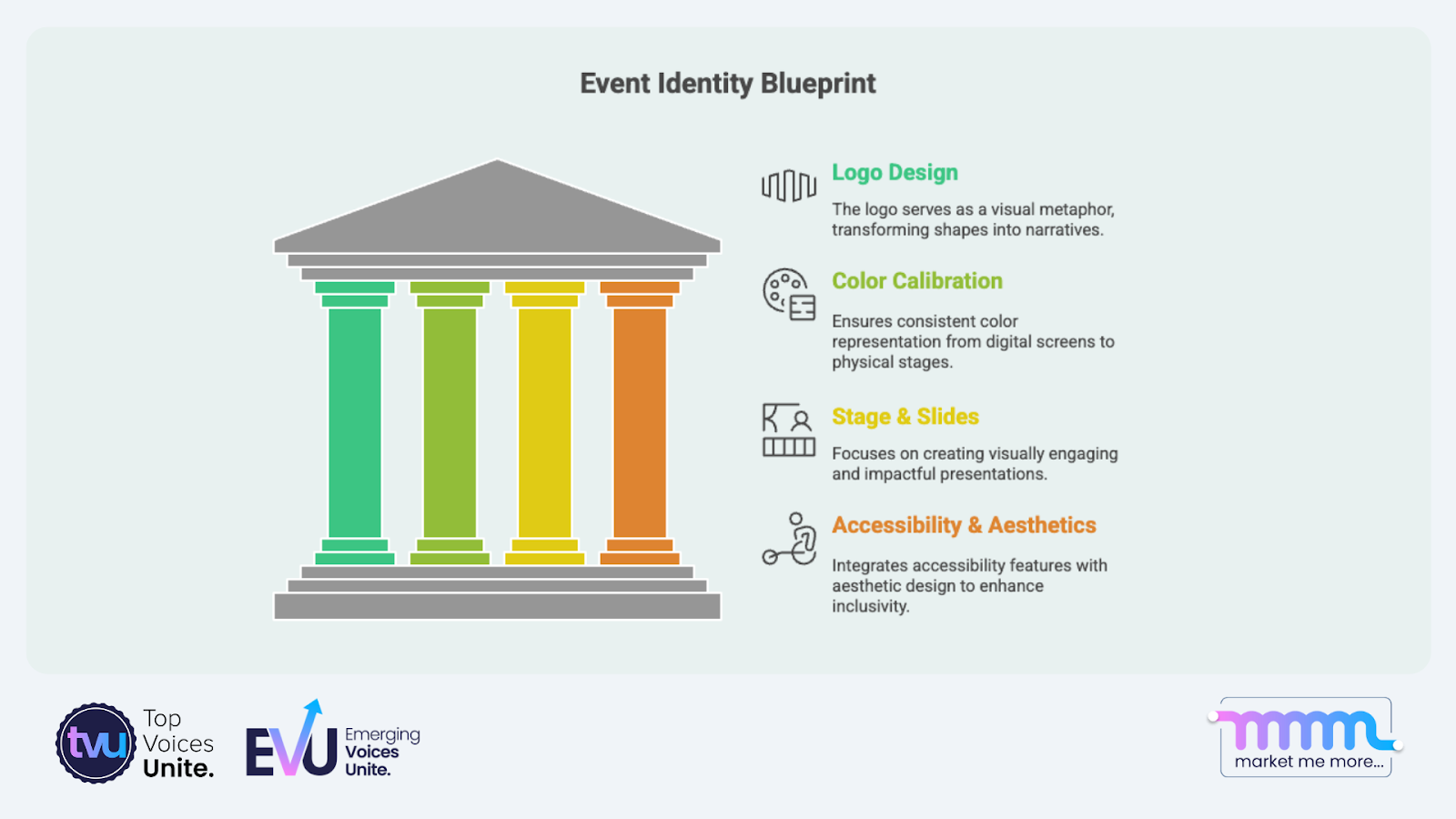

4 Creative Blueprint Moves That Power Event Identity

1. Logo as Metaphor: Shape Transforms Into Story

Ash tested 8–9 logo concepts before landing on blobs—fluid forms that evolve from circles into organic shapes. This reflects the summit’s core theme of continuous transformation. This approach is reminiscent of branding strategies used by agencies like Pentagram that treat identity as a dynamic system.

2. Color Calibration: From Screen to Stage

Ash emphasized precision when converting digital gradient aesthetics into physical prints. Gradient brilliance often gets lost in translation from RGB to CMYK—a subtle but critical challenge. According to Canva’s design guide, careful color matching and test proofs are essential to preserve vibrancy across media.

3. Stage & Slides Built to Elevate

Ash didn’t just design slides; he scripted the entrance moment. Each speaker had a custom intro slide crafted with glassmorphism, setting the tone before they ever walked on stage. The use of layered transparency and blur helps focus attention—best practices seen in modern UI/UX design. This aligns with Market Me More's event branding framework emphasizing visual consistency to elevate speaker credibility.

Check out this blog to know the 3-Stage Conference Marketing Strategy to Get the Best ROI on Your Next Event

4. Accessibility Meets Aesthetic

Ash also noted how the design process took inclusivity into account. Font choice, color contrast, and visual spacing were adapted to ensure readability for all ages and abilities—especially important in a summit targeting longevity and diversity. According to W3C accessibility standards, accessible design not only broadens audience reach but boosts overall user satisfaction.

Real-World Applications

From narrative shapes to emotional resonance to brand cohesion—this conversation reminds us that design is the vessel for what’s often unspoken. Ash K and Nikki Estes didn’t just build a look—they seeded intention, healing, and belonging. In a world overloaded with visuals, the strongest brands will be those that feel first, not just seen.

“Design is the vessel for what can’t always be said.” — Ash K

What To Do Next

📺 Catch the full Live with Top Voices Unite episode here: Voices of the Week: Behind the Brand of Ageless Evolution Summit

Explore more from our Voices of the Week host and guest speaker in this episode!

- Connect with Ash Kumar for more thinking on emotional identity and creative intentionality.

- Connect with Nikki Estes CEO of Market Me More and founder of Top Voices Unite and Emerging Voices Unite, helping leaders navigate AI, generational shifts, and visibility with integrity.

🗞️ Subscribe for More to get behind-the-scenes leadership insights and community updates from @Nikki Estes, Top Voices, Emerging Voices and the Market Me More team.

The Science of Healing: How Trauma Impacts Generational Wealth & Longevity

Last October 7, 2025, host Nikki Estes led an eye-opening edition of Voices of the Week, featuring two trailblazing women: Syama Bunten, wealth strategist and creator of Getting Rich Together, and Ruschelle Khanna, LCSW, licensed clinical social worker and expert in generational healing. Together, they unpacked the link between inherited trauma, emotional wellness, and financial longevity—challenging common assumptions about success, mindset, and what it means to truly build lasting wealth.

Why This Conversation Matters

If you've ever wondered why smart, high-achieving people still struggle with money wounds or self-sabotage, you're not alone. Syama Bunten and Ruschelle Khanna, LCSW pulled back the curtain on the emotional coding behind financial behavior, arguing that trauma-informed wealth building isn't just therapy—it’s strategy. And in an era where generational wealth and wellness are increasingly intertwined, this conversation couldn’t be more urgent.

4 Transformational Takeaways on Healing Money Trauma

1. Inherited Trauma Can Outweigh Financial Literacy

"Even the best money advice will fail if you're still repeating your family's pain patterns," noted Ruschelle.

Many individuals unknowingly carry generational wounds that sabotage their financial growth, regardless of how well they budget or invest. Psychology Today supports this by stating that trauma is often passed down epigenetically, influencing behavior across generations.

2. Healing Doesn’t Start with a Bank Statement—It Starts with Awareness

“People come to me thinking they need a new income stream. What they really need is to unpack why they’re afraid to be seen with money,” said Syama Bunten.

This level of reflection echoes research from Berkeley’s Greater Good Science Center, which shows emotional intelligence and financial resilience are closely tied.

3. Grief and Wealth Are Linked in Unexpected Ways

Ruschelle revealed that “unprocessed grief from a parent or grandparent can make us afraid to build wealth—as if thriving dishonors their struggle.”

According to research published by the Journal of Financial Therapy, unresolved grief can manifest in financial self-sabotage and risk aversion.

4. Why Money Mindset Is a Wellness Strategy, Not Just a Wealth Tactic

“Money is emotional, but so is generational healing,” said Syama during a powerful exchange with Ruschelle.

Host Nikki Estes emphasized how trauma often disguises itself in our financial behaviors—and how naming it is the first step to healing. This insight echoes Abacus Wealth’s view that a mature money mindset requires emotional clarity, not just strategy.

Impact You Can Use

If you’ve ever felt stuck in your financial journey despite doing “all the right things,” this conversation might hold the key.

Nikki Estes, Syama Bunten, and Ruschelle Khanna, LCSW didn’t just talk about money—they deconstructed the emotional and ancestral programming behind it. The message is clear: To truly grow your wealth, you must first heal your history.

“You’re not broken. You’re likely just carrying a story that was never yours to begin with.” — Ruschelle Khanna, LCSW

Ready to Take the Next Step?

📺 Catch the full Live with Top Voices Unite episode here: Voices of the Week: Releasing Inherited Trauma for Wealth & Longevity

Explore more from our Voices of the Week host and guest speaker in this episode!

- Connect with Syama Bunten and Ruschelle Khana ffor more on emotional wealth and generational healing

- Connect with Nikki Estes CEO of Market Me More and founder of Top Voices Unite and Emerging Voices Unite, helping leaders navigate AI, generational shifts, and visibility with integrity.

🗞️ Subscribe for More to get behind-the-scenes leadership insights and community updates from @Nikki Estes, Top Voices, Emerging Voices and the Market Me More team.

How to Crack the Code to AI‑Driven Growth: Lessons from Ashley Boekstaaf

Last Thursday at 10 AM ET, Jose Kiggundu sat down with Ashley Boekstaaf, founder and CEO of Top Tier AI, to unpack how AI can amplify brand visibility and business growth without sacrificing authenticity. Rather than chasing hype, Ashley broke down how structured AI systems, clarity in message, and ethical automation can help creators and entrepreneurs scale with heart.

Before firing up another AI tool, pause. This isn’t about replacing the human. It’s about elevating your human impact with intelligent systems that reflect your voice. Think of this as your guide to combining authenticity and automation—so your brand presence scales, but your essence remains.

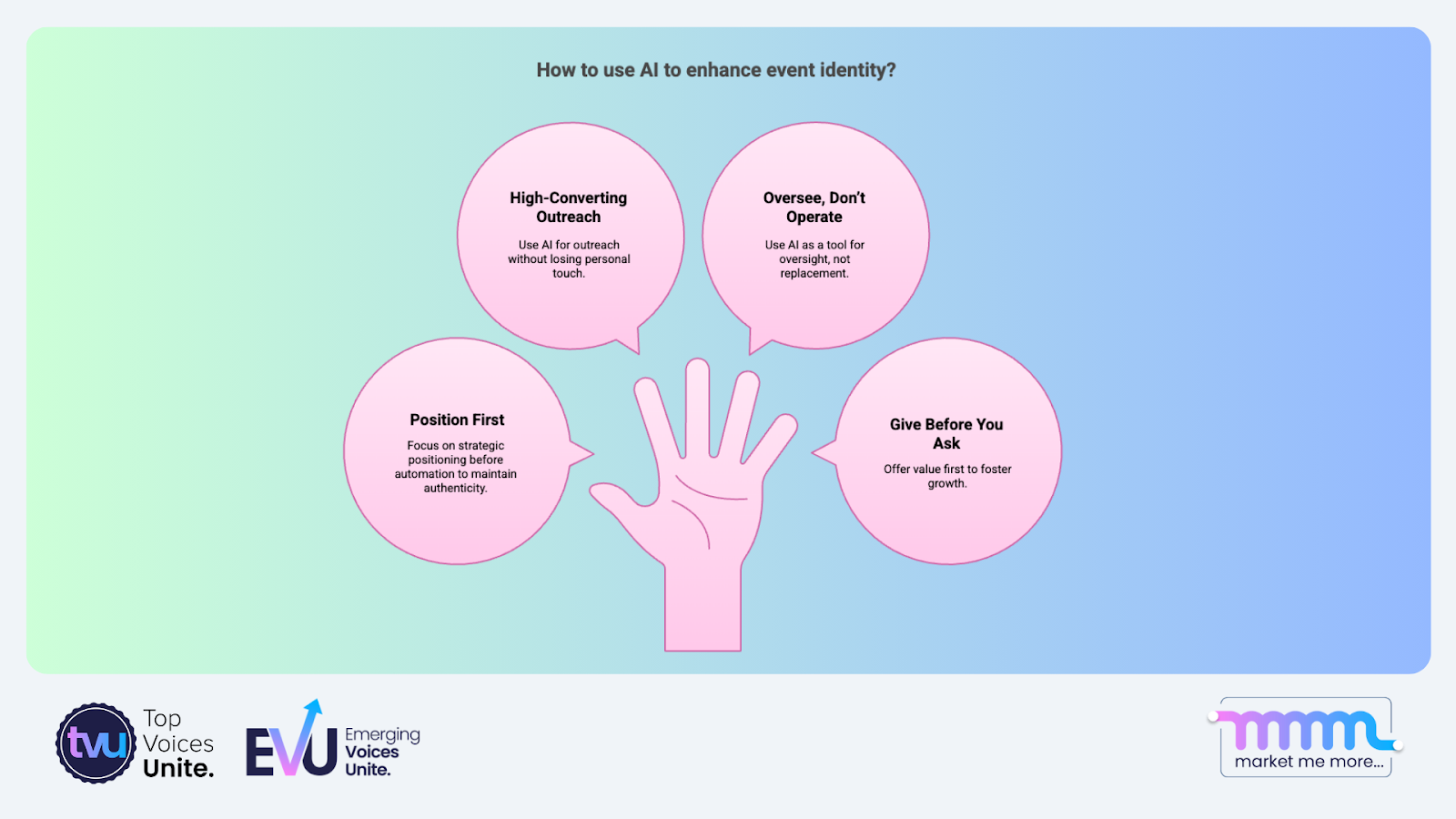

Here are 4 AI-powered playbooks Ashley shared:

4 AI Playbooks That Elevate Influence Without Diluting Authenticity

1. Position First, Automate Later

“AI is not about removing authenticity. It’s about scaling your effort without losing your voice.” — Ashley Boekstaaf

Ashley emphasized that before AI generates your output, your positioning must be crystal clear. She teaches AI her own mission, audience, and tone so each post reflects her brand, not the tool. This aligns with how AI can contribute to brand consistency when guided by a strong identity.

See how brands maintain authenticity while scaling with AI: How AI Is Shaping Brand Identity and Authenticity in 2025 by UpGrowth.

2. High-Converting Outreach Doesn’t Need to Feel Robotic

Ashley uses AI to help craft customized messages at scale—each DM or connection request is tailored to the prospect. The difference? It’s not just about personalizing variables, but injecting emotional context. This echoes the approach in MMM’s post on AI + LinkedIn strategy:

“AI‑driven learning, LinkedIn strategies, and inbound tactics that build trust, boost visibility, and attract meaningful engagement.”

Such strategies allow outreach to feel human—even when many messages are sent.

3. Oversee, Don’t Operate: AI as Your Right Hand

With her systems, Ashley clones her voice across email, LinkedIn, and content pipelines. But she also manually audits AI output so it stays true to her brand. This balance of automation + oversight mirrors broader industry advice: brands must use AI to scale human connection—not replace it.

(Forbes) Authenticity At Scale: 5 Ways AI Is Transforming Business Development – “AI can enhance … helping us understand clients and prospects better”

4. Give Before You Ask: Value as a Growth Engine

“People don’t buy services. People buy people. Relationships come before revenue.” — Ashley Boekstaaf

Ashley’s trust-first model gives away value—free audits, insights, micro-tools—before asking for a signup. This soft approach attracts clients who already see your value, making conversion smoother and relationships stronger.

The Takeaway That Counts

This conversation uncovers a truth that too many skip: AI doesn’t replace your voice—it amplifies it when wielded wisely. Ashley’s blueprint shows that the magic lies not in shortcuts, but in preparation: clear positioning, creative integrity, emotional outreach, and trust-first engagement.

As AI proliferates, authenticity becomes your most defensible moat. Tools can scale labor; but people scale essence. In a world of output overload, your clarity, your convictions, and your values will become your signal—what separates you from the noise.

“You can’t just hand AI your brand and walk away. You guard your voice by how you train the system to speak for you.”

This episode reminds creators, founders, and leaders: growth isn’t just about reach. It’s about resonance. Use AI—but don’t let it use you.

Level Up Your Journey

📺 Catch the full Cracking the Code to AI-Driven Growth episode here: The people behind the posts! Learning from Ashley

- Connect with Ashley Boekstaaf in Linkedin and Follow her on instagram @theashleyboekstaaf for AI tips, tricks, and education

- Stay connected with Jose Kiggundu for behind-the-scenes looks into Top Voices, practical business storytelling tips, and exclusive event insights.

🎁 Ashley’s Gift to Listeners:

“As a thank you for being on this platform and giving back to those eager to learn, we’re offering free business audits to 20 people this month to help uncover opportunities where AI can save you time, cut costs, and boost growth.”

👉 Send Ashley a LinkedIn connection request with the word AUDIT to claim your spot.